Gender equality in the workforce is not a new topic, but one that requires persistent discussion and influence in an effort to close the gap that stubbornly remains. Much of the focus is on compensation differences as well as the lack of equal opportunity in leadership positions. The social aspect can overtake the resulting dilemma that women face in retirement. In a report published last year1, TIAA outlined the many challenges women face in retirement as a result of earning less, working less, taking less investment risk, and living longer.

Gender equality in the workforce is not a new topic, but one that requires persistent discussion and influence in an effort to close the gap that stubbornly remains. Much of the focus is on compensation differences as well as the lack of equal opportunity in leadership positions. The social aspect can overtake the resulting dilemma that women face in retirement. In a report published last year1, TIAA outlined the many challenges women face in retirement as a result of earning less, working less, taking less investment risk, and living longer.

Financial Insecurity

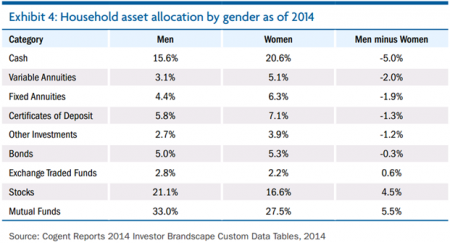

Much has been written about the gender pay gap, including speculation on the reasons behind its persistence. The fact is that the gender pay gap and its myriad consequences for women in retirement are real and manifest differently for each individual. For some, it leads to a persistent sense of financial insecurity. This may manifest in a higher allocation to low yielding investments. A study by Cogent Reports in 2014, cited in the TIAA report1, shows that on average men hold 5 percent less in cash investments than women and about 5 more in stocks and mutual funds.

Combine the lower expected long-term returns of a more conservative investment allocation with the fact that women tend to outlive men and it’s no wonder why many women worry about running out of money. As we all live longer, our time in retirement has extended. Without a sufficient level of risk in our investment portfolio, we may just simply be replacing market risk with longevity risk, or the risk that we do outlive our money.

Men vs. Women: Who is the More Successful Investor?

It is important to note that many studies point to women as being more successful investors than men in general. Much of this may be attributable to a more patient, disciplined investment style that is more prevalent with women. Generalizations can be a double-edged sword and may lead to unfair assumptions. The point is that despite perhaps an edge in the implementation of an investment strategy, women appear to be less willing to accept investment risk. This factor in isolation may contribute to a less successful long-term financial plan.

Prevention is the First Line of Defense

While solving the gender pay gap would go a long way to closing the gender retirement gap, we need to focus effort on what we can directly control. As with our personal health, prevention has a greater impact than treatment. So what steps can women take to overcome the gap that exists in retirement? The TIAA report cites three strategies for improving financial security in retirement; save more, increase investment risk, and invest in a form of guaranteed lifetime income.

While all three may be good, general pieces of advice, they don’t actually solve the problem. How much more should you save? How much more risk do you need to take? Is investing in a guaranteed lifetime income product a good idea in all situations? What are the opportunity costs of each of these decisions? These are fundamental questions that everyone should seek to answer based on their personal financial situation and long-term goals. For women in particular, lower lifetime earnings, fewer hours worked and a longer life expectancy all contribute to the answers being all the more vital.

1To see the TIAA report, click here.